How to Report Cryptocurrency Income on Taxes: Your Definitive SEO Guide

Navigating the complex world of cryptocurrency taxation can feel like deciphering an ancient blockchain. As a professional SEO expert and content strategist, I understand the critical importance of clear, accurate, and comprehensive information. This definitive guide will demystify how to report cryptocurrency income on taxes, ensuring you understand your obligations, minimize your tax burden legally, and maintain full compliance with the IRS. Whether you're a seasoned trader, a hodler, or new to the digital asset space, understanding the tax implications of your crypto activities is paramount. This article provides actionable insights and practical advice to help you confidently manage your crypto tax reporting.

Understanding the Basics: Is Your Crypto Taxable?

The Internal Revenue Service (IRS) views cryptocurrency as property for tax purposes, not currency. This fundamental classification dictates how various crypto activities are taxed. Just like stocks or real estate, your digital assets are subject to capital gains tax when sold or exchanged. However, the nuances extend far beyond simple buying and selling, encompassing a wide range of "taxable events" that can trigger reporting requirements.

Key Taxable Events in Cryptocurrency

Understanding which actions constitute a taxable event is the first step in successful crypto tax compliance. Many people mistakenly believe that only selling crypto for fiat currency (like USD) is taxable, but the reality is more expansive:

- Selling Cryptocurrency for Fiat Currency: This is the most straightforward taxable event. When you sell Bitcoin for USD, you realize a capital gain or loss depending on the difference between your sale price and your original cost basis (what you paid for it, including fees).

- Trading One Cryptocurrency for Another: Often overlooked, this is also a taxable event. If you exchange Ethereum for Solana, the IRS treats it as if you sold your Ethereum for its fair market value at the time of the trade, then immediately used those proceeds to buy Solana. Any gain or loss on the Ethereum is taxable.

- Using Cryptocurrency to Purchase Goods or Services: When you spend crypto to buy anything from a coffee to a car, it's considered a disposition of property. You're effectively selling your crypto at its fair market value at the time of the transaction, and any gain or loss is taxable.

- Receiving Cryptocurrency as Income: This category is broad and includes several scenarios where crypto is treated as ordinary income, taxed at your regular income tax rates. This can include:

- Mining Rewards: The fair market value of newly mined crypto at the time of receipt is considered ordinary income.

- Staking Rewards: Similar to mining, the fair market value of crypto received from staking activities is typically treated as ordinary income when you gain control over it.

- Airdrops: The fair market value of crypto received from an airdrop is generally considered ordinary income at the time of receipt, unless it's a gift.

- DeFi Yields: Income earned from decentralized finance protocols (e.g., lending, liquidity provision) is generally ordinary income.

- Crypto as Wages/Payment for Services: If you're paid in crypto for work, its fair market value at the time of receipt is ordinary income.

Non-Taxable Events (Generally)

Not every crypto activity triggers a tax event. It's equally important to know what doesn't:

- Buying and Holding Cryptocurrency: Simply purchasing crypto and holding onto it in your wallet is not a taxable event. The tax liability arises only when you dispose of it.

- Transferring Cryptocurrency Between Your Own Wallets: Moving crypto from one of your own wallets (e.g., from an exchange to a hardware wallet) is not a taxable event. However, it's crucial to maintain meticulous records of these transfers to accurately track your cost basis.

- Gifting Cryptocurrency: If you gift crypto to another individual, it's generally not a taxable event for the giver, as long as the gift amount is below the annual exclusion limit ($18,000 per recipient in 2024). The recipient receives the donor's cost basis.

The Core Principle: Capital Gains and Losses

Most cryptocurrency transactions fall under the umbrella of capital gains and losses. This is where accurate record keeping becomes absolutely critical.

Short-Term vs. Long-Term Capital Gains

The duration you hold a cryptocurrency before disposing of it significantly impacts its tax treatment:

- Short-Term Capital Gains: Apply to crypto held for one year or less. These gains are taxed at your ordinary income tax rates, which can be as high as 37% (as of 2024).

- Long-Term Capital Gains: Apply to crypto held for more than one year. These gains are taxed at more favorable rates: 0%, 15%, or 20%, depending on your overall taxable income. This distinction highlights the significant tax advantages of "hodling" for longer periods.

Understanding your holding period for each unit of cryptocurrency is essential for accurate reporting. This is especially challenging for active traders with numerous transactions.

Calculating Your Cost Basis

Your cost basis is the original value of an asset for tax purposes, typically its purchase price plus any associated fees. When you sell or exchange crypto, your gain or loss is calculated as: Fair Market Value at Sale - Cost Basis = Capital Gain/Loss.

For crypto, determining your cost basis can be complex, especially if you've bought the same crypto at different prices or transferred it across multiple platforms. The IRS allows several accounting methods:

- First-In, First-Out (FIFO): This is the default method if you don't specify otherwise. It assumes that the first coins you acquired are the first ones you sell. While straightforward, it might not always be the most tax-efficient, especially in a volatile market.

- Last-In, First-Out (LIFO): Assumes the last coins you acquired are the first ones you sell. This can be beneficial in a rising market to realize higher cost basis and potentially smaller gains.

- Specific Identification: This is generally the most tax-efficient method. It allows you to choose which specific units of crypto you are selling, enabling you to select units with a higher cost basis (to reduce gains) or a lower cost basis (to realize losses for tax-loss harvesting). To use this method, you must be able to identify the specific units, their purchase date, and cost. This is where robust record keeping and crypto tax software become indispensable.

Essential Tools and Strategies for Crypto Tax Compliance

Given the sheer volume and complexity of crypto transactions, relying on manual calculations is often impractical and prone to error. Professional tools and diligent practices are key to accurate reporting.

The Power of Crypto Tax Software

For anyone serious about crypto investing, dedicated crypto tax software is no longer a luxury but a necessity. These platforms automate the aggregation of your transaction data, calculate your gains and losses, and generate the necessary tax forms. Look for software that offers:

- Extensive Exchange and Wallet Integrations: The ability to import transaction history from all major exchanges (Coinbase, Binance, Kraken, Gemini, etc.) and various wallets (hardware, software) is crucial.

- Support for Diverse Transaction Types: Ensures accurate handling of trading, staking, mining, DeFi, NFTs, and other complex activities.

- Multiple Cost Basis Methods: Allows you to choose between FIFO, LIFO, and Specific Identification to optimize your tax outcome.

- IRS Form Generation: Automatically prepares forms like Form 8949 and Schedule D, ready for import into your preferred tax filing software or for your tax professional.

- Error Checking and Reconciliation: Helps identify missing data or discrepancies in your transaction history.

Popular options include CoinTracker, Koinly, TaxBit, and CryptoTaxCalculator, each with varying features and pricing models. Investing in reliable software can save countless hours and prevent costly mistakes.

Meticulous Record Keeping is Non-Negotiable

Even with advanced software, your commitment to thorough record keeping is paramount. The software is only as good as the data you feed it. For every crypto transaction, you should ideally record:

- Date and Time of Transaction: Precise timing is vital for holding period calculations and fair market value.

- Type of Transaction: Buy, sell, trade, receive (staking, mining, airdrop), spend, gift, transfer.

- Asset Involved: The specific cryptocurrency (e.g., BTC, ETH, SOL).

- Quantity of Crypto: How much was bought, sold, or received.

- Fair Market Value (FMV) in USD: The price of the crypto at the exact moment of the transaction. This is especially important for income events (mining, staking) and for calculating gains/losses on trades or spending.

- Transaction Fees: Any fees paid in crypto or fiat, as these add to your cost basis or reduce your proceeds.

- Source and Destination Wallets/Exchanges: Helps track transfers and reconcile data.

- Purpose of Transaction: A brief note (e.g., "purchased goods," "staking reward").

Many exchanges provide downloadable transaction history, but often this data needs to be consolidated and cleaned for accurate reporting, especially if you use multiple platforms.

Specific Scenarios: Beyond Simple Buying and Selling

The digital asset landscape is constantly evolving, introducing new complexities for tax purposes. The IRS continues to issue new IRS guidance, but many areas remain gray.

Reporting Staking Rewards and Airdrops

As mentioned, staking rewards and airdrops are generally considered ordinary income at their fair market value at the time you receive them and have control over them. This means you owe income tax on them in the year they are received. When you later sell or trade these specific coins, their initial fair market value becomes your cost basis for calculating subsequent capital gains or losses.

Decentralized Finance (DeFi) and NFTs

DeFi activities introduce a myriad of tax considerations:

- Lending and Borrowing: Earning interest on lent crypto is ordinary income. Borrowing generally isn't a taxable event, but liquidations or defaults can trigger gains/losses.

- Liquidity Mining/Yield Farming: Rewards (e.g., LP tokens, governance tokens) are typically ordinary income at their FMV when received. Subsequent sales of these tokens are capital gains/losses.

- Wrapped Tokens (e.g., wBTC): Generally, wrapping or unwrapping a token is not a taxable event as it's often seen as a 1:1 exchange of the same underlying asset.

NFTs (Non-Fungible Tokens) are also treated as property. Selling an NFT results in a capital gain or loss. If the NFT is considered a "collectible" by the IRS, long-term capital gains can be taxed at up to 28%, higher than standard long-term rates. Creating and selling NFTs can also be considered self-employment income if it's a business activity.

Gifts and Inheritances of Cryptocurrency

If you receive crypto as a gift, it's generally not taxable to you upon receipt. Your cost basis for future calculations will be the donor's basis (or the fair market value at the time of gift, if lower, for loss calculations). If you inherit crypto, your cost basis is "stepped up" to its fair market value on the date of the decedent's death, which can be a significant tax advantage for heirs.

Navigating IRS Forms for Crypto Reporting

The actual act of reporting your crypto income on taxes involves specific IRS forms. While tax software can automate much of this, understanding the underlying forms is crucial.

Form 8949: Sales and Other Dispositions of Capital Assets

This is the primary form for reporting all your cryptocurrency sales, trades, and spending. Every single taxable disposition of crypto is listed here, detailing:

- Description of property (e.g., "1 BTC")

- Date acquired

- Date sold

- Proceeds from sale

- Cost basis

- Gain or loss

Your crypto tax software will generate this form, often with hundreds or thousands of lines for active traders.

Schedule D: Capital Gains and Losses

The totals from Form 8949 are then transferred to Schedule D. This form summarizes your total short-term and long-term capital gains and losses, which then flows to your main Form 1040.

Schedule 1: Additional Income and Adjustments to Income

If you've received crypto as ordinary income (e.g., from mining, staking, airdrops, or as payment for services), this income is reported on Schedule 1 (Line 8z, "Other Income").

Other Relevant Forms

Depending on your activities, other forms might be necessary:

- Schedule C (Form 1040): Profit or Loss from Business (Sole Proprietorship): If your crypto activities constitute a trade or business (e.g., professional miner, NFT artist), you might report income and expenses here.

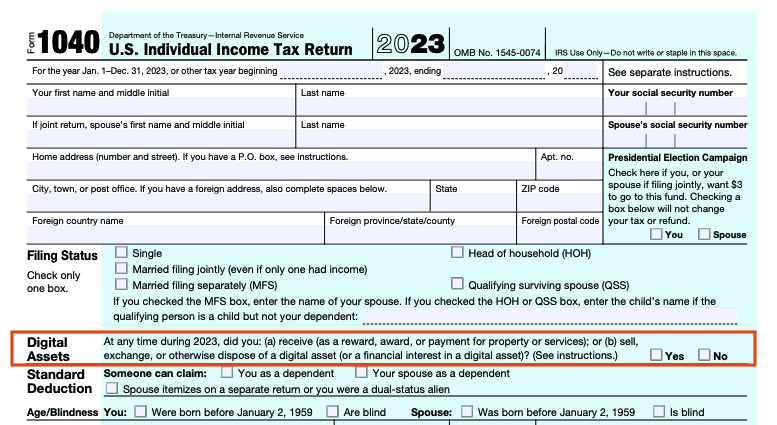

- Form 1040: U.S. Individual Income Tax Return: All your income, deductions, and credits ultimately flow to this main form.

- FinCEN Form 114 (FBAR): Report of Foreign Bank and Financial Accounts: If you hold crypto on foreign exchanges or in foreign wallets exceeding $10,000 in aggregate value at any point during the year, you might need to file an FBAR.

Actionable Tips for Stress-Free Crypto Tax Season

Proactive planning and understanding common pitfalls can make a significant difference in your crypto tax experience.

- Start Early and Stay Organized: Don't wait until April 14th. Begin gathering your transaction data from all exchanges and wallets throughout the year. Regular reconciliation can prevent last-minute panic.

- Understand the "Wash Sale Rule" (and its current crypto applicability): For traditional securities, the wash sale rule prevents you from claiming a loss on a sale if you buy back "substantially identical" securities within 30 days. Currently, the IRS has not explicitly applied this rule to cryptocurrency, meaning you can potentially sell crypto at a loss and immediately buy it back to harvest losses. However, this is an evolving area, and future IRS guidance could change this. Always consult with a tax professional.

- Consider Professional Tax Advice: For complex situations (high volume trading, extensive DeFi, business use of crypto), a tax professional specializing in digital assets can be invaluable. They can help optimize your tax strategy and ensure compliance.

- Don't Forget About Foreign Accounts (FBAR): If you use non-U.S. crypto exchanges and your aggregate foreign account balances (including crypto) exceed $10,000, you have an obligation to file an FBAR. This is separate from your tax return and carries significant penalties for non-compliance.

- Be Prepared for Audits: The IRS is increasingly sophisticated in tracking crypto transactions. Ensure your records are impeccable and can withstand scrutiny. Transparency and accuracy are your best defense. Utilize your transaction history from exchanges and wallets to back up all reported figures.

- Utilize Tax-Loss Harvesting: Strategically selling crypto at a loss to offset capital gains (and potentially up to $3,000 of ordinary income) is a powerful tax planning technique. This requires careful timing and understanding of your cost basis.

Frequently Asked Questions

What happens if I don't report my crypto income?

Failing to report cryptocurrency income can lead to severe penalties from the IRS. This includes fines, interest on unpaid taxes, and potentially criminal charges for tax evasion. The IRS is actively increasing its enforcement efforts, sending out warning letters (like CP2000 notices) and utilizing data analytics to identify non-compliant taxpayers. Given the transparency of public blockchains, the IRS has increasing visibility into digital asset transactions, making non-compliance a high-risk gamble. It's always best to err on the side of caution and report accurately.

Is transferring crypto between my own wallets a taxable event?

No, transferring cryptocurrency between your own wallets (e.g., from an exchange to a hardware wallet, or from one personal software wallet to another) is generally not a taxable event. It's considered a non-taxable internal transfer, as there is no change in ownership. However, it is crucial to keep meticulous records of these transfers. This helps maintain an accurate cost basis for your assets and avoids confusion when you eventually dispose of the crypto, allowing you to demonstrate to the IRS that no sale or exchange occurred.

How do I report crypto losses to offset gains?

You report crypto losses on IRS Form 8949, just like gains. These losses are then summarized on Schedule D. Capital losses can be used to offset capital gains dollar-for-dollar. If your total capital losses exceed your total capital gains, you can deduct up to $3,000 of the remaining loss against your ordinary income each year. Any excess capital loss can be carried forward indefinitely to offset future capital gains or ordinary income, making tax-loss harvesting a valuable strategy for managing your overall tax liability.

Does the IRS know about my crypto transactions?

Yes, increasingly so. U.S.-based crypto exchanges are generally required to issue Form 1099-B (for brokers) or other 1099 forms (e.g., 1099-MISC for certain income) to users who meet specific thresholds, and they also report this information directly to the IRS. Furthermore, the IRS employs blockchain analytics firms to trace transactions on public ledgers. They also issue "John Doe" summonses to exchanges to obtain customer data. The infrastructure for tracking cryptocurrency tax compliance is growing, making it increasingly difficult for transactions to go unnoticed.

What is the "cost basis" for cryptocurrency, and why is it important?

Your cost basis for cryptocurrency is the original value you paid for it, including any fees, which is used to calculate your capital gain or loss when you sell, trade, or spend it. For example, if you bought 1 ETH for $2,000 and paid $10 in fees, your cost basis is $2,010. If you later sell that ETH for $3,000, your taxable gain is $3,000 - $2,010 = $990. The cost basis is absolutely critical because it directly determines the amount of your taxable gain or deductible loss. Without an accurately tracked cost basis for each unit of crypto, it's impossible to correctly report your tax obligations, potentially leading to overpaying taxes or facing penalties for underreporting.

0 Komentar