NFT Insurance: Safeguarding Your Digital Assets from Theft and Cyber Threats

In the burgeoning world of digital collectibles and decentralized finance, Non-Fungible Tokens (NFTs) have emerged as revolutionary digital assets, representing everything from unique art and music to virtual real estate and gaming items. Yet, with great value comes great risk. The rapid ascent of NFTs has unfortunately coincided with a rise in sophisticated cyber threats, making the phrase "NFT insurance protecting your NFTs from theft" more than just a trending topic – it's a critical necessity. This comprehensive guide delves deep into how specialized insurance solutions offer a vital layer of protection, shielding your invaluable digital property from the ever-present dangers of hacking, phishing, and smart contract vulnerabilities. Understand the evolving landscape of blockchain security and discover the proactive measures and insurance options available to safeguard your investment in the Web3 ecosystem.

The Evolving Threat Landscape for Digital Assets

The allure of NFTs, driven by their scarcity and potential for appreciation, has unfortunately made them prime targets for malicious actors. Unlike traditional physical assets, NFTs exist on a blockchain, a distributed ledger system, which inherently offers a high degree of transparency and immutability. However, the interfaces through which users interact with these blockchains – primarily cryptocurrency wallets and decentralized applications (dApps) – often present exploitable vulnerabilities. Understanding these threats is the first step in effective digital asset protection.

Common Methods of NFT Theft and Loss

- Phishing Attacks: These remain one of the most prevalent forms of cybercrime. Scammers create fake websites, emails, or social media profiles that mimic legitimate platforms (e.g., NFT marketplaces, wallet providers) to trick users into revealing their private keys or seed phrases. Once compromised, the attacker gains full control over the victim's wallet and can transfer all NFTs and other digital assets.

- Wallet Hacks and Exploits: While blockchain itself is highly secure, the software and hardware wallets used to store NFTs can be vulnerable. This includes vulnerabilities in browser extensions, desktop applications, or even physical hardware wallets if they are not properly secured or if their firmware is exploited. Malware designed to steal credentials or directly drain wallets is a significant concern.

- Smart Contract Vulnerabilities: Many NFT projects rely on complex smart contracts to manage ownership, transfers, and specific functionalities. Flaws or bugs in these contracts can be exploited by attackers, leading to unauthorized transfers of NFTs, minting of fake NFTs, or even locking up legitimate assets, making them inaccessible. This is a critical area where specialized blockchain security expertise is paramount.

- Social Engineering: Beyond technical exploits, attackers often leverage human psychology. This can involve impersonating support staff, offering fake opportunities (e.g., free NFT drops), or creating a sense of urgency to pressure users into making rash decisions that compromise their security.

- Rug Pulls and Project Scams: While not direct theft of existing NFTs, these scams involve creators abandoning a project after raising funds, leaving investors with worthless NFTs. While not typically covered by theft insurance, they highlight the broader risks in the NFT space.

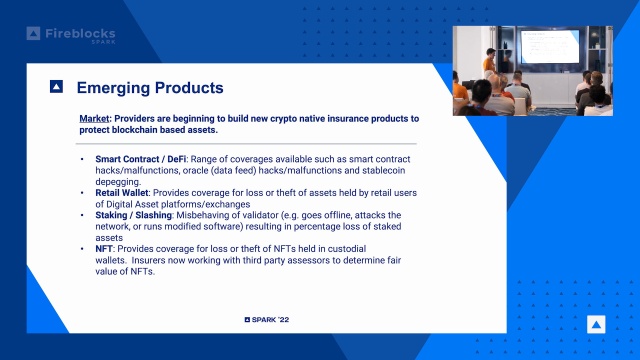

What is NFT Insurance and How Does It Work?

Just as you insure your car or home, NFT insurance is designed to protect your valuable digital assets against specific risks, primarily theft and loss due to cyber incidents. It's a nascent but rapidly evolving field, reflecting the growing maturity and institutional interest in the Web3 space. These policies aim to provide financial compensation to NFT owners in the event of a covered loss.

Key Components of an NFT Insurance Policy

- Coverage Scope: Policies vary widely, but most focus on losses resulting from external cyberattacks, such as phishing, wallet hacks, and sometimes smart contract exploits. Some policies may also cover accidental loss due to user error, though this is less common.

- Valuation: Determining the value of an NFT can be complex due to market volatility. Policies typically use various methods for valuation at the time of loss, such as purchase price, market price on reputable marketplaces (e.g., OpenSea, Rarible), or an agreed-upon appraisal.

- Claims Process: Similar to traditional insurance, policyholders must file a claim, provide evidence of the loss (e.g., transaction IDs, police reports if applicable, incident logs), and cooperate with the insurer's investigation.

- Premiums and Deductibles: As with any insurance, premiums are paid periodically, and a deductible (the amount the policyholder pays before insurance kicks in) may apply. These are influenced by the value of the NFTs, the security measures in place, and the perceived risk.

The emergence of crypto insurance policies signifies a crucial step towards mainstream adoption, providing a much-needed layer of risk management for investors navigating the volatile digital asset market. It helps bridge the gap between traditional finance and the decentralized world.

Key Benefits of NFT Insurance

For serious collectors and investors, NFT insurance offers more than just financial reimbursement; it provides a crucial sense of security in an otherwise unpredictable environment.

- Financial Recovery: The most direct benefit is the ability to recover the financial value of your stolen or lost NFTs. Given that some NFTs are valued at millions of dollars, this can prevent catastrophic financial losses.

- Peace of Mind: Knowing that your valuable digital assets are protected allows collectors to engage more confidently in the NFT market, reducing anxiety associated with potential cyber threats. This psychological benefit is often underestimated.

- Legitimizing the Asset Class: The availability of insurance for NFTs helps to legitimize them as a serious asset class, attracting more institutional investors and traditional financial players who require robust protection mechanisms. This contributes to the overall stability and growth of the Web3 economy.

- Encouraging Adoption: By mitigating some of the inherent risks, NFT insurance can encourage wider adoption among individuals and businesses who might otherwise be hesitant to invest in digital collectibles due to security concerns.

- Enhanced Due Diligence: Insurers often require policyholders to meet certain security standards, implicitly encouraging better cyber security practices among NFT owners. This can include recommendations for using hardware wallets or multi-factor authentication.

Navigating the Complexities: What NFT Insurance Typically Covers (and Doesn't)

Understanding the specific perils covered by an NFT insurance policy is vital. Not all losses are insurable, and exclusions can be significant.

Typical Coverage Areas:

- Wallet Compromise Due to External Cyberattack: This is the core coverage. It usually includes losses resulting from phishing scams, malware, brute-force attacks, or other unauthorized access to your wallet that leads to the theft of your NFTs.

- Smart Contract Vulnerabilities (Specific Policies): Some advanced policies may cover losses due to exploits in the smart contracts governing the NFTs, provided the vulnerability was not publicly known or the result of the owner's negligence. This is a complex area, often requiring detailed technical analysis.

- Exchange or Custodian Hacks (If applicable): If your NFTs are held in a custodial wallet by an exchange or third-party service, some policies might cover losses stemming from a hack of that platform. However, many policies require self-custody.

Common Exclusions and Limitations:

- User Negligence: If the loss is a direct result of your own negligence, such as sharing your private keys, falling for obvious scams, or failing to enable basic security features (like 2FA), the claim may be denied.

- Market Volatility and Price Depreciation: NFT insurance does not protect against the fluctuating market value of your NFTs. If the value drops, that's a market risk, not an insurable event.

- Rug Pulls or Project Failure: As mentioned, if an NFT project's creators abandon it, rendering your NFT worthless, this is generally not covered as it's a business risk, not a theft or cyberattack.

- Illegitimate NFTs: If the NFT you purchased turns out to be counterfeit or an unauthorized copy of another work, it might not be covered, especially if due diligence wasn't performed at the time of purchase.

- Losses from Unsecured Wallets: Some policies may have strict requirements regarding the type of wallet used (e.g., requiring hardware wallets for high-value assets) and may exclude losses from less secure hot wallets.

Beyond Insurance: Proactive Measures to Protect Your NFTs

While NFT insurance offers financial recourse, the best defense is always prevention. Implementing robust Web3 security practices is paramount to protecting your digital assets.

Essential NFT Security Best Practices:

- Use Hardware Wallets (Cold Storage): For high-value NFTs, a hardware wallet (e.g., Ledger, Trezor) is indispensable. These devices keep your private keys offline, making them virtually impervious to online hacks. This is the gold standard for asset protection.

- Secure Your Seed Phrase/Private Keys: Your seed phrase is the master key to your wallet. Never store it digitally (on your computer, cloud, or email). Write it down on paper and store it in a secure, fireproof, and waterproof location, or use specialized metal seed phrase storage solutions. Never share it with anyone.

- Enable Multi-Factor Authentication (MFA): Wherever possible, enable 2FA or MFA on all your crypto accounts, exchanges, and even email accounts linked to your crypto activities.

- Be Vigilant Against Phishing: Always double-check URLs, sender addresses, and social media handles. Bookmark official sites and only access them through those bookmarks. Never click on suspicious links or download attachments from unknown sources.

- Understand Smart Contracts: Before interacting with a new dApp or minting an NFT, understand the permissions you are granting. Be wary of requests that seem excessive or unusual. Tools like Revoke.cash can help you review and revoke approvals for dApps.

- Separate Wallets for Different Activities: Consider having a "hot" wallet for daily transactions and a "cold" wallet (hardware) for long-term storage of valuable NFTs. This limits exposure if your hot wallet is compromised.

- Regularly Audit Permissions: Periodically review and revoke token approvals you've granted to dApps that you no longer use or trust.

- Stay Informed: The crypto security landscape evolves rapidly. Stay updated on common scams, new vulnerabilities, and best practices from reputable sources. Follow blockchain security experts and communities.

- Use Strong, Unique Passwords: For any online accounts related to your NFTs, use complex, unique passwords and a password manager.

- Be Skeptical of "Too Good To Be True" Offers: Free NFT drops, exclusive whitelist opportunities, or high-return investment schemes are often fronts for scams.

Choosing the Right NFT Insurance Provider

As the market matures, more providers are entering the NFT insurance space. Selecting the right one requires careful consideration.

Factors to Consider When Selecting an Insurer:

- Reputation and Experience: Look for providers with a strong track record in the broader crypto insurance market or reputable underwriters. This is a niche field, so experience in decentralized finance (DeFi) and digital assets is crucial.

- Coverage Scope and Exclusions: Thoroughly read the policy documents. Understand exactly what is covered (e.g., phishing, wallet hacks, smart contract exploits) and, more importantly, what is explicitly excluded (e.g., user negligence, market risk).

- Valuation Methodology: How will your NFT be valued at the time of loss? Is it based on purchase price, current market value, or an agreed-upon appraisal? This can significantly impact your payout.

- Claims Process Efficiency: A transparent and efficient claims process is vital. Inquire about the typical timeline for claims processing and the required documentation.

- Security Requirements: Does the insurer mandate specific security measures (e.g., hardware wallets, 2FA)? Compliance with these requirements is often necessary for a valid claim.

- Customer Service: Assess their responsiveness and willingness to answer your questions thoroughly.

- Cost and Deductibles: Compare premiums and deductibles across different providers to find a balance between cost and comprehensive coverage.

- Geographic Coverage: Ensure the insurer operates in your region.

Some emerging players in this space are leveraging decentralized insurance protocols, where risk is shared among a pool of participants, offering a new paradigm for crypto insurance. These models often use smart contracts to automate payouts, increasing transparency and efficiency.

The Future of Digital Asset Protection

The landscape of NFT insurance is still in its infancy, but it's evolving rapidly. As the Web3 economy grows, so too will the demand for sophisticated protection mechanisms. We can anticipate several trends:

- Standardization of Policies: As the market matures, there will likely be greater standardization of NFT insurance policies, making it easier for consumers to compare offerings.

- Integration with Wallets and Marketplaces: Imagine being able to purchase insurance for your NFT directly from your wallet or an NFT marketplace with a few clicks. This seamless integration will improve accessibility.

- Parametric Insurance: This type of insurance pays out automatically if certain predefined conditions are met (e.g., a specific smart contract exploit occurs), without a lengthy claims investigation. This could be particularly relevant for covering specific smart contract risks.

- Greater Data and AI Use: Insurers will increasingly leverage blockchain data and artificial intelligence to better assess risks, price policies, and detect fraudulent claims.

- Specialized Coverage for Specific NFT Categories: As NFTs diversify (e.g., gaming assets, real estate NFTs), we might see highly specialized policies tailored to the unique risks of these sub-categories.

The journey towards full maturation of digital asset protection is ongoing, but the advent of NFT insurance marks a significant milestone, offering crucial reassurance in a world increasingly defined by digital ownership. Protecting your NFTs from theft isn't just about financial recovery; it's about securing your stake in the decentralized future.

Frequently Asked Questions

What types of NFTs can be insured?

Generally, any NFT with verifiable ownership on a blockchain can be insured. This includes digital art, collectibles, gaming items, virtual land, music NFTs, and more. The primary considerations for insurers are the NFT's verifiable existence, its unique identification, and a reasonable method for determining its value. High-value NFTs, in particular, are strong candidates for comprehensive NFT asset protection policies.

Is NFT insurance expensive?

The cost of NFT insurance, like any insurance, varies based on several factors: the value of the NFT(s) being insured, the scope of coverage (e.g., just theft, or also smart contract exploits), the security measures implemented by the policyholder (e.g., use of a hardware wallet), and the insurer's risk assessment. While it can be a significant investment for high-value assets, the cost is typically a small percentage of the NFT's value, offering valuable peace of mind against potential cybercrime losses.

How do I prove my NFT was stolen for an insurance claim?

Proving NFT theft typically requires concrete evidence. This includes transaction hashes showing unauthorized transfers out of your wallet, logs or screenshots related to phishing attempts, reports to law enforcement (if applicable), and any communication with the platform where the theft occurred. Insurers will conduct a thorough investigation, often involving forensic analysis of blockchain data and digital footprints, to verify the claim and rule out user negligence. Maintaining meticulous records of your NFT purchases and security practices is crucial for a successful asset recovery process.

Can NFT insurance protect against "rug pulls" or project failures?

No, standard NFT insurance policies are primarily designed to protect against theft, hacking, and specific cyber vulnerabilities. They do not typically cover financial losses due to market volatility, the depreciation of an NFT's value, or the failure of an NFT project (a "rug pull"). These are considered investment risks, not insurable events related to theft or cyberattack. Investors should conduct thorough due diligence on projects before investing to mitigate these risks.

0 Komentar